Trampolines not traps: Listening to single mothers about what needs to change

Low-income single mothers continue to be caught in the binds of poverty and insecurity, with limited choices and opportunities. Despite some policy changes, including a temporary increase in social security payments and suspension of mutual obligation requirements, the underlying infrastructure of inequality remains. In today’s analysis, Dina Bowman (@Dina_Bowman) and Seuwandi Wickramasinghe, both of the Brotherhood of St Laurence (@BrotherhoodInfo), share a summary of their recently-published report Trampolines not traps: Enabling economic security for single mothers and their children.

The $550 a fortnight Coronavirus supplement to many social security payments, including Parenting Payment Single, has made a difference for many. But the government’s plans to reduce the supplement will push single mums back into the poverty and uncertainty they experienced before the pandemic. And will affect up to 1.1 million children whose parents receive the supplement.

Single mothers are not getting the policy support they need to bounce back from adversity. Photo by Jasper Garratt on Unsplash

Our newly-released research report draws on policy analysis and insights from 27 interviews with single mums conducted in Victoria prior to the pandemic. It proposes a multidimensional framework for understanding and achieving economic security for low-income single mothers and their children.

Structures of inequality

At 35 per cent, single-parent families have the highest poverty rates of family types. Children in single-parent families are more than three times as likely to live in poverty as children in couple families—44 per cent compared with 13 per cent.

Low-income single mothers are caught in webs of insecurity. Employment, social security, taxation and child support policies that should support and enable, instead combine to undermine their economic security, limiting their real freedoms and harming them and their children in the short and long term.

Contradictions, constraints and tough choices

Single mothers told us their main barriers to economic security included the following:

Even with careful budgets, making ends meet is a struggle

The single mothers we interviewed had to skimp on food, heating and clothing and their children missed out on school activities and social events. Poverty also affected mothers’ mental health and wellbeing. The mothers we interviewed experienced high levels of anxiety, distress, exhaustion and sleeplessness from being caught in a never-ending cycle of trying to make ends meet.

The clash between unpredictable work and fixed hours of child care limit mothers’ choices

Like most Australian women with young children, most of the participants in this study had jobs and worked part-time. As single mothers, however, they were caught in a bind: wanting to care for their children, and provide financially for them, but without the policy infrastructure that would support them to do so. Working more hours did not represent a neat solution because an increase in earnings meant losing income support and associated concessions. The mothers we interviewed spent a lot of their time calculating and recalculating earnings to ensure continued eligibility for income support and government payments. The lack of appropriate child care was also major stumbling block. Those who worked non-standard hours faced greater challenges, having to stitch together child care arrangements.

Conditional and confusing social security creates anxiety and undermines economic security

The women we talked to were caught between inflexible work and inflexible social security arrangements. Those who did not have sufficient work hours to fulfil their social security participation requirements had to also show evidence of job search, training or volunteering in an approved activity. Fear of making a mistake and risking suspension, cancellation of payments or incurring a debt was widespread. They wanted to report their earnings correctly, but it was hard to do so, especially for those with non-standard and intermittent employment such as cleaners, kitchenhands, tutors, performing artists or subcontractors, or working on their own account.

Unfair child support

For the women in this study, child support payments when received tended to be low—as little as $16 a fortnight for two children. The unfair child support system compounds women’s insecurity, especially when the non-custodial parent fails to pay or fails to declare income. Some former partners avoided paying a fair amount of child support by exploiting loopholes in the system such as non-lodgement of tax returns, or undertaking cash-in-hand work to reduce their taxable income.

Altogether, the combination of a mismatch between unpredictable hours of work and fixed hours of childcare, confusing and inadequate social security with counterproductive compliance measures, and an unfair child support system undermines the economic security of single mothers and their children. While a trampoline provides the ability to bounce back, the women in this study said what they needed was a sound foundation on which they could build good lives for themselves and their children. This requires a new and sustained investment in social infrastructure.

Trampolines not traps: building infrastructures of equality and economic security

Reform is required in multiple interrelated domains: not only in family-friendly, inclusive employment and flexible, affordable quality child care, but also in taxation, social security and child support policy. Our policy recommendations include:

Invest in universal access to quality child care and early learning to enable women’s workforce participation and to enhance their children’s opportunities.

Address the very high effective marginal tax rates that affect single mothers who wish to increase hours of work.

Extend eligibility for benefits such as the Pensioner Concession Card for mothers moving off PPS (currently 12 weeks) until they are established in employment.

Remove the Targeted Compliance Framework from people in receipt of Parenting Payment Single.

Establish an independent Social Security Commission to set, monitor and review social security payment rates.

Review the adequacy and indexation arrangements of Family Tax Benefit A and B.

Improve access to the social security system for women who have experienced family violence, and streamline access to crisis payments.

Reform the gendered nature of child support and family law

Develop enabling programs to support single mothers

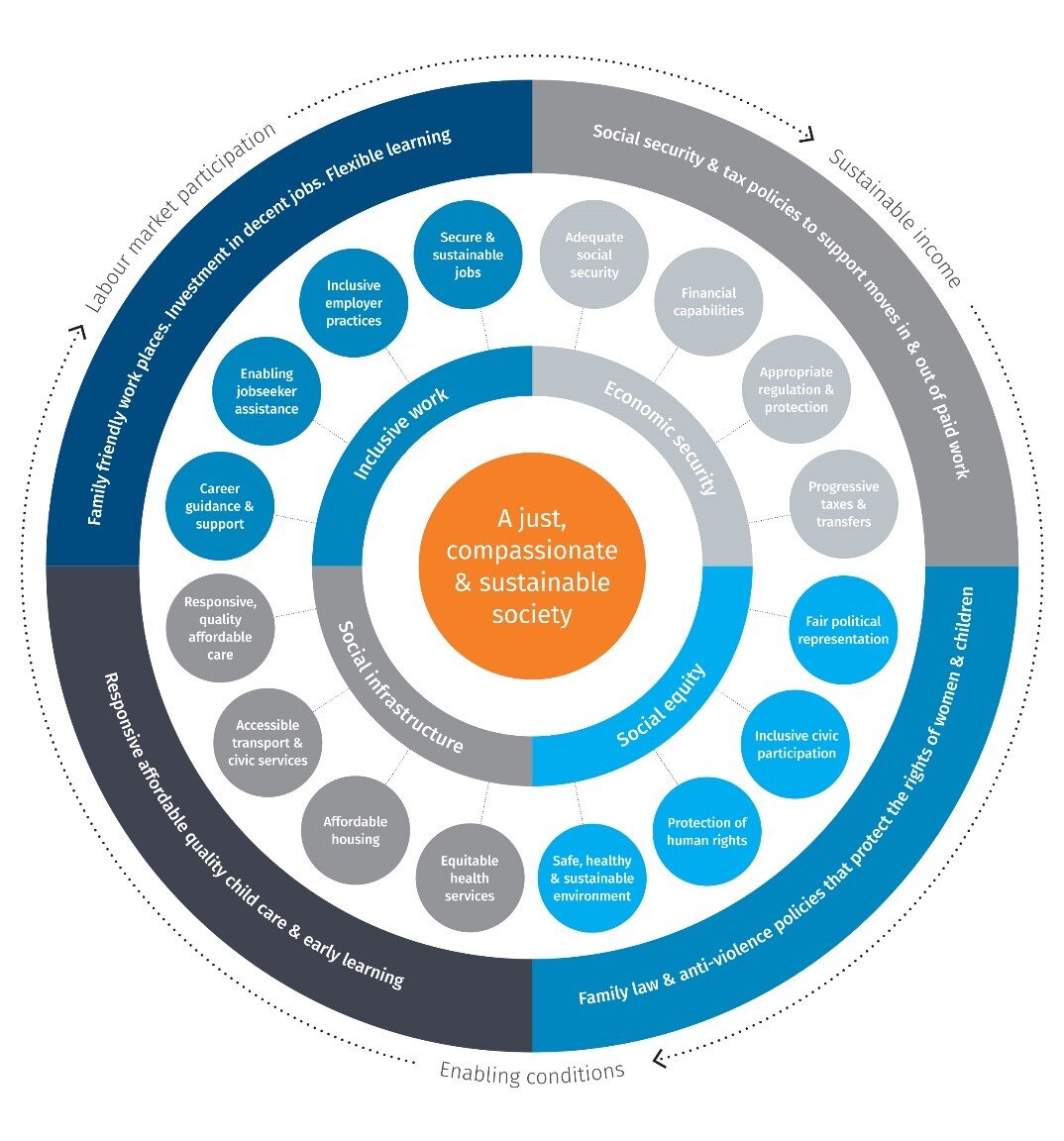

Figure 1: A work and economic security framework for single mothers and their children

To highlight the enabling conditions that single mothers and their children require we suggest the following framework, which helps to situate our program, policy and research efforts—which may be at a micro or a macro level—and helps to build a coherent vision of a society that promotes gender equity and recognises the value of unpaid work and care.

The COVID-19 pandemic has demonstrated how increased social security payments and free child care can enable single mothers and their children to escape economic insecurity. This points the way to a new approach to supporting families and preventing poverty.

Read the full report: Trampolines not traps: Enabling economic security for single mothers and their children