Budget 2014: the pursuit of small government

The Federal budget has been controversial and divisive. Sold as a measure to manage a ‘budget crisis’ , Joe Hockey’s first budget will come as a hard blow for many disadvantaged, low income and vulnerable Australians. But beneath the rhetoric and justifications, we can see a familiar political goal. In this comprehensive article below, Professor David Hayward (RMIT University) delves into the underlying story shaping the 2014/15 budget:

The 2014/15 Federal budget was set up to be a harsh one. Expectations were well-managed, thanks to the release of the Federal Commission of Audit only a week prior to the budget and also some selective media releases emphasizing the alleged parlous state of the nation’s finances.

For next financial year – what budgets have traditionally been about – pundits could be forgiven for wondering what all the fuss was about. Spending cuts of almost $2b were announced, as well as revenue increases of $700m. With expenses in total running at around $420b, this is not a lot of money by any standards.

But this budget was not about 2014/15. Nor was it about a budget crisis. As set out on page one of Budget Paper Number 1, its purpose was to “transform the role of government in peoples’ lives”.

That is code for making government smaller, a goal that has proven to be remarkably difficult over a very long period of time. Despite the best of intentions, it is a goal that eluded Malcolm Fraser back in the late 1970s and early 1980s. It eluded John Howard in the 2000s. And now it is over to Joe Hockey to kick the right wing goal that those before him have missed.

His strategy is to lock in a savings strategy which will require the best part of 4 years to take full effect. Next year is just the first installment, with the bulk of the cuts yet to come.

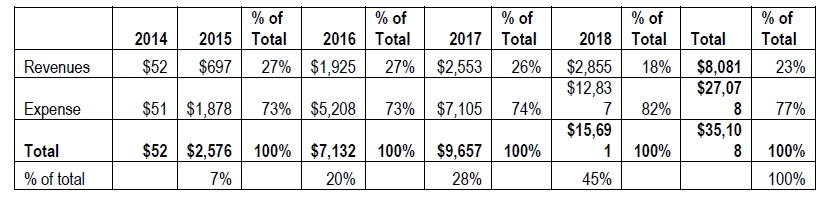

As Table 1 shows, three quarters of the total budget adjustment will be borne by expenses. Expense reductions and revenue increases next year account for 7% of the total adjustment that is meant to take place in the four years to 2017/18. The pain won’t really start to be felt till the year after next.

Table 1: Revenue and expense savings measurers announced in the 2014/15 Federal budget, constant prices (2013/14=100. Deflated by the CPI) ($m)

And then it will come with a punch that will last another three years, if the Government is able to hold the line that is.

Three revenue measures account for 42% of the increases: the tax surcharge on high income earners, which will peak in 2016/17 time and then be reduced to zero two years later; and the decision to index fuel excise, which will be permanent and the single biggest revenue earner announced in the budget accounting for around one quarter of the additional revenues raised over the forward estimates.

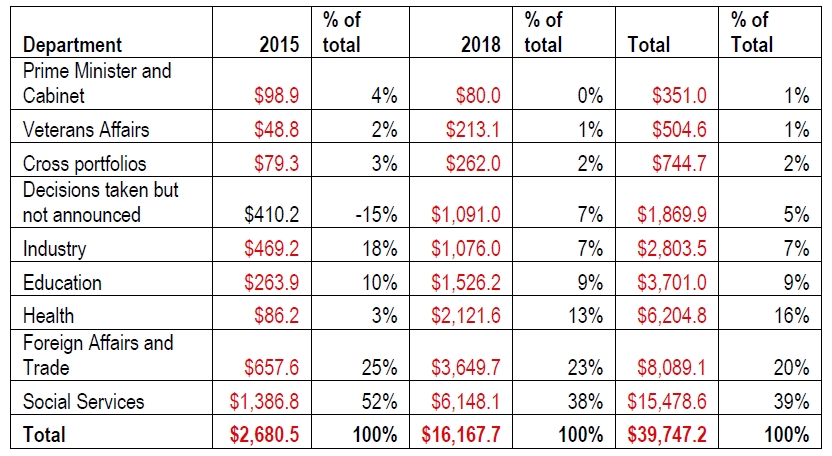

More interesting in many ways is the distribution of the expense cuts. This is shown in Table 2.

Table 2: Expense reductions by department, 2014/15-2017/18 and total ($m) (red means a cut)

Three quarters of the cuts will come from three departments: Social Services (which will account for half of next year’s spending cuts), Foreign Affairs and Trade and Health, with a further 9% coming from Education. The bulk of these cuts is regressive and permanent.

The budget is not all bad news. The States will be pleased to see that the GST tide is coming back in, with consumers spending up more than previously thought, delivering badly stretched budgets much needed cash. The not-so-good news is that the Government has signaled its intention to reduce specific purpose payments into the outyears, as part of a yet-to-be announced rationalization of Commonwealth-State relations.

But the biggest news is the amount of money that has been found to pay for an amazing lift in disability spending. This is tipped to increase from $26b in 2013/14 to hit $42b by 2017/18, with the National Disability Insurance Scheme spending set to rise from $300m to over $11b over this time period. This major initiative has not only survived the cuts, but is set to bloom despite the election of a Government not known to be a friend of social policy.

Astute budget watchers have known all along that the main problem with Commonwealth finances is not expenses, which have remained relatively flat as a percentage of the economy over the last decade, falling under Howard, then climbing due to Rudd’s stimulus measures, then falling slightly since then. The problem is one of revenues, which have stubbornly refused to bounce back following the end of the GFC.

This budget has done very little to fix this problem. But then that was not its goal, which was to shrink the size of government to bring it into line with a smaller revenue base. The budget will move a little bit in this direction next financial year, with the bulk of the adjustment not due to take effect until shortly before the next election. That’s a strange choice of timing for a Government that continues to struggle in the polls.

Posted by Pauline McLoughlin